T-bill rates ease ahead of further rate cuts

Treasury Bills auction results, May 26, 2025

MANILA, Philippines – Yields on short-dated government securities eased across all tenors at Monday’s auction as investors scrambled to lock in returns ahead of expected policy rate cuts, allowing the government to raise more than its initial offer.

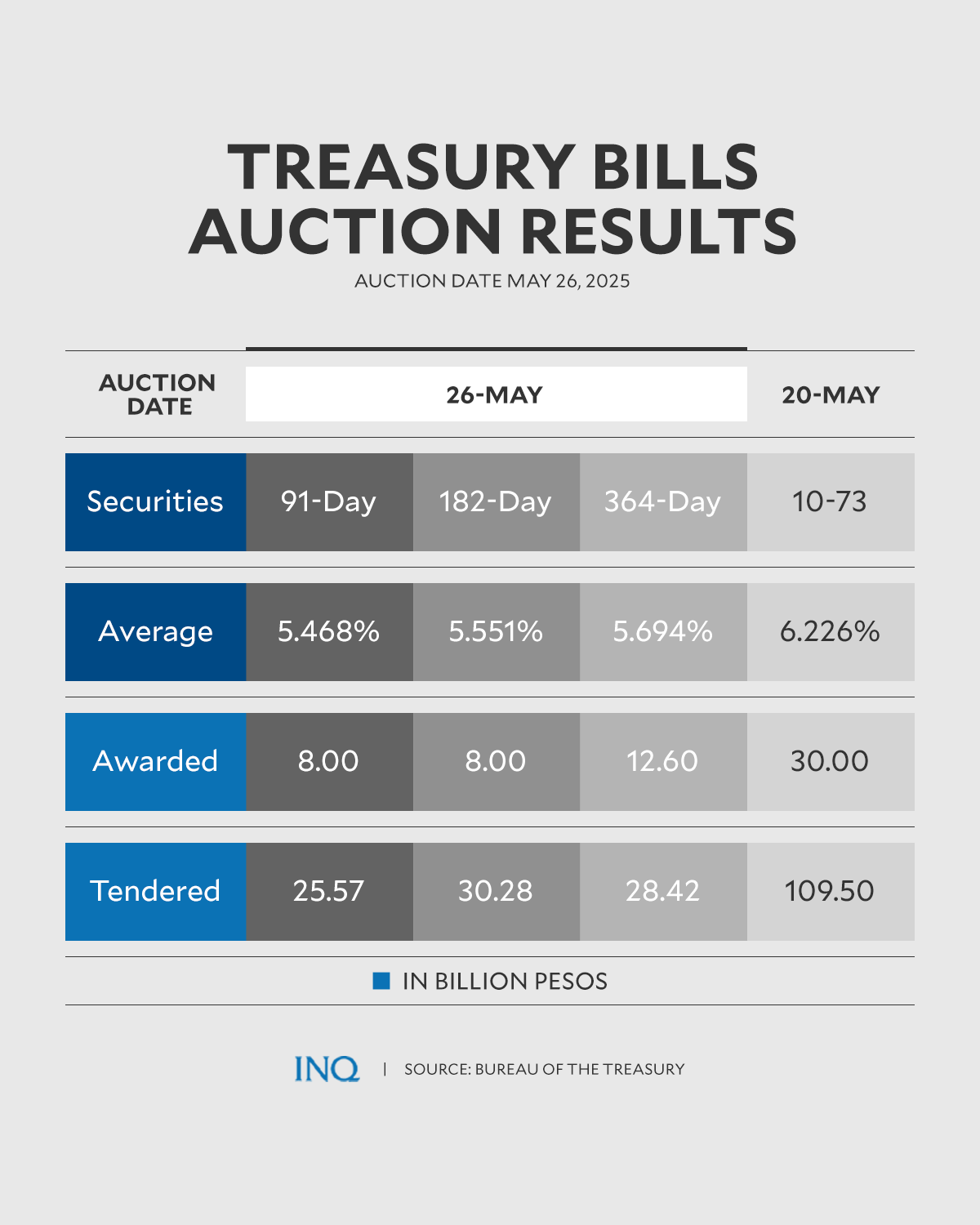

The Bureau of the Treasury (BTr) fully awarded P28.6 billion in bids for 91-day, 182-day and 364-day Treasury bills (T-bills).

Rates for the three tenors averaged 5.468 percent, 5.551 percent and 5.694 percent, respectively, all lower than the previous auction.

READ: T-bill rates mixed amid spike in US Treasury yields

Investor demand was strong, with total tenders reaching P84.3 billion, which is more than three times the amount offered.

The strong demand prompted the auction committee to double acceptance of non-competitive bids for the 364-day tenor to P7.2 billion, up from the standard P3.6 billion.

Rizal Commercial Banking Corp. chief economist Michael Ricafort attributed the easing yields to expectations of policy rate cuts by the Bangko Sentral ng Pilipinas (BSP), alongside declining short-term market benchmarks and improving inflation conditions.

“The Treasury bill average auction yields again mostly slightly eased, after the comparable short-term PHP BVAL (Bloomberg Valuation) yields mostly slightly declined week-on-week,” he said.

Ricafort was referencing the latest signals from BSP Governor Eli Remolona Jr. of two more rate cuts for the rest of this year.

He added that expectations of further reserve requirement ratio cut in 2026 and a stronger peso, which recently hit its best level against the US dollar in nearly two years, were also helping temper inflationary pressures.

Falling global oil prices were also contributing to lower import costs, further tempering inflation risks, he added.